Who gets access to your digital assets, accounts when you are dead?

Digital deaths: An Insight package

Recovering the digital trail of a dead loved one is complicated - with or without a will.

CHAPTERS

SINGAPORE - When his father suddenly died from illness in January, Mr Tan Zhi Liang and his family were unaware about the online accounts and mobile subscriptions worth at least $200 each month that were tied to his father's name.

There was no will or notes to point them to the TV network, mobile and cloud storage subscriptions held by his father, who worked as a managing director at a media firm before he retired five years ago.

"It was only when his bank bill came did we realise he signed up for quite a few other apps and subscriptions," said Mr Tan, 29. Even for a simple man with a few assets to his name, having some form of documentation to pick up the digital trail could have come in handy, said Mr Tan, who is self-employed in the finance industry.

Digital assets are increasingly being discussed in wills and end-of-life documentation as digital services become more intertwined in people's lives.

Out of 16 local law firms that responded to queries from The Straits Times, 12 said that clients over the last two years have increasingly asked about how to manage their digital estate, including digital banking and cryptocurrencies. In rare cases, clients have also asked for social media accounts and tech devices to be included in wills.

A guide by My Legacy @ LifeSG, a government site for end-of-life matters, includes financial accounts, e-mail, social media, online business accounts and tech devices as digital assets. Leaving these assets unattended can incur further charges or lead to identity theft, said the guide.

Queries on how to manage these assets have risen over the last two years with increased digitalisation, said lawyers. They expect the trend to grow as the more tech-savvy younger generations consider preparing their wills.

Ms Nancy Thio, a lawyer at Yuen Law, said monthly queries from clients about listing digital assets in their end-of-life documents have nearly doubled over the last two years. She said: "Traditionally, we've always been asked about bank accounts and properties, but recently, we have seen more people asking about what happens to their crypto, or other types of digital assets like NFTs (non-fungible tokens) that are of value and can be willed away upon their death."

Family lawyer Lim Chong Boon of PKWA Law said that he too received nearly two times more queries yearly about listing digital assets in wills over the last two years, but clients do not usually name these assets in the final copy.

Family lawyer Lim Chong Boon of PKWA LawnoneThe client normally states that 'all assets' will go to a person or their family, so this will also include digital

assets.The client normally states that 'all assets' will go to a person or their family, so this will also include digital

assets.

The client normally states that 'all assets' will go to a person or their family, so this will also include digital

assets.

Other firms note that the interest is marginal but likely to grow. Ms Gloria James-Civetta, who specialises in estate, family and criminal law, said that there has been at least 20 per cent more clients who include digital assets in their estate documents, from two years ago.

The benefit of having a will is that an executor can be named to manage the assets of a dead loved one.

Most financial institutions accept a court letter to hand over assets to an executor. While waiting for the official documents, the bank can also help to freeze the person's account, putting all transactions on hold.

The process can be complicated if the members of the family disagree with the contents of the will, which typically results in a trial to decide how the assets should be split, said lawyer Ryan Yu, founder of Aspect Law Chambers.

In the absence of a will, the person's assets are distributed to the spouse or immediate family, as per the Intestate Succession Act of Singapore.

Terms you need to know

Executor: Someone who is appointed by a will or a court to handle the estate of someone who has died.

Grant of probate: An order from the court that gives the executor of a will the right to distribute the dead person's assets. Banks, for instance, need to receive the grant of probate before handing over the reins of an account to an executor.

Grant of letters of administration: A court order that gives someone the legal authority to handle the estate of a person who has died without a will. This generally takes more time to acquire than a grant of probate.

Lasting power of attorney: A document that allows you to appoint a trusted person to make decisions on your behalf if you lose mental capacity.

Intestate: A person who died without a will, which means that their property will be distributed according to the law.

Non-fungible token (NFT): Unique digital tokens tied to a blockchain that represent ownership of an item.

Lawyers interviewed by ST said they have yet to see digital currencies such as cryptocurrencies and NFTs listed as assets in their clients' wills, but clients have occasionally asked about how their crypto assets can be dealt with.

NFTs have garnered greater recognition as property. In its first written judgment on a case involving NFTs, the Singapore High Court ruled in 2022 that the tokens – tagged to digital assets that are verified on a blockchain – can be considered as property.

Cryptocurrency in crypto trading platforms like Coinbase and Gemini can be withdrawn by an executor with the necessary legal documents, similar to a typical bank's processes.

To cancel subscriptions tied to his father's Apple account, Mr Tan contacted the bank to halt transactions. Even getting the bank to act took time, as the court order took eight weeks to be prepared, said Mr Tan, who eventually gained access to his father's account with a lucky guess of the password.

Even with a will, family members are often left in the dark, as most clients rarely specify the full list of assets to be entrusted to their family, simply referring to the assets in general, said Mr Yu, a family lawyer.

Without these details, lawyers often contact major banks and other institutions to check if the dead person has any assets with them, he said. "But it's like fishing," said Mr Yu. "We check with a list of popular institutions to see which ones are a hit."

Digital assets that hold value should be included in a will, as it can be tricky for family members to access the accounts, said Mr Subra M. Suppiah, director of Subra TT Law.

He suggested leaving a note along with the will that lists the digital assets owned, including the credentials and security questions and answers needed to unlock the account.

Few lawyers have seen social media accounts included in wills, as they are generally not worth any money. But this could become more common soon, as the social media or Web accounts of influencers or those with intellectual property could have market value, said Ms James-Civetta.

There are tech solutions to help people when unexpected events happen. The Singapore Government, for one, allows individuals to document their financial, health, legal and funeral wishes in the My Legacy digital vault.

The platform offers a step-by-step guide to help users prepare a will, indicate where they want to be buried or cremated, and prepare a lasting power of attorney application, which hands over decisions to a trusted person if they lose their mental capacity. A user can add a trusted contact who will be notified after the user's death to view the contents of the vault. These steps clearly identify the individuals who are responsible for the dead person's estate and to whom certain assets should be handed over.

OCBC Bank also provides a free online will generator service, which is available to non-OCBC customers. Users are advised to print and store the will generated in a safe location that is made known to the Wills Registry so that the appointed executor will be informed. The will is valid only if it has been endorsed by the applicant and two witnesses, said OCBC.

OCBC said that close to 40 wills are completed on the service each month.

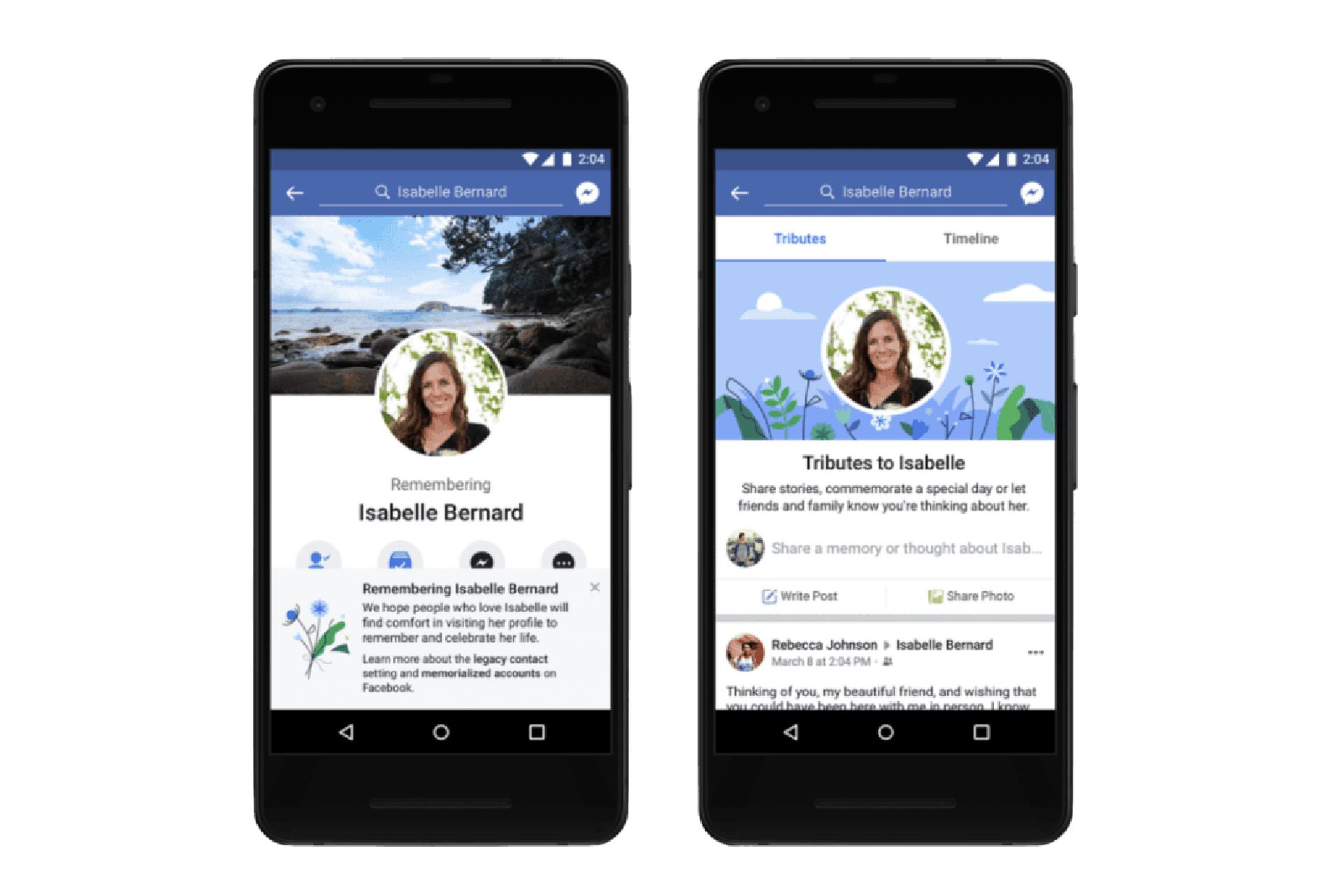

Personal tech device makers and social media platforms handle dead users' accounts differently. With legal documentation submitted to them, platforms like Twitter can shut down an account, while others like Instagram and Facebook can convert the account of the user into a memorial account. In some cases, inactive accounts will also be automatically closed after a few years.

A handful of tech manufacturers and online platforms allow users to assign trusted contacts – or Legacy Contacts – to manage their account after they die. If legacy contacts had not been assigned before death, tech vendors typically do not disclose information on the personal devices of their dead owners to any third parties.

For instance, Google customers can assign an inactive account manager who can be given partial access to select apps – or all of them – if the account is inactive after a specified period. The trusted contact will be granted access to data in Google Drive, Gmail, YouTube and Blogger after the account is deemed inactive.

Passwords stored on password management app LastPass can also be shared with emergency contacts, as long as it had been set up earlier with the user's approval.

Similarly, Apple said on its support page that designated trusted contacts can be granted access to an Apple account after the user's death, in an update from 2021. They can access some data that includes photos, voice memos, messages, call history and other files.

Rajah and Tann partner Khelvin Xu, who handles digital disputes, said that social media firms are justified in being cautious about handing a dead user's account or data to others. "What if the deceased had an expectation of privacy, and wanted access to their accounts to 'die' with them and take some secrets to the grave? These are difficult questions and I hesitate to say that there is a one-size-fits-all answer."